Decoding Form 2848: Power of Attorney and Declaration of Representative

Jan 08, 2024 By Triston Martin

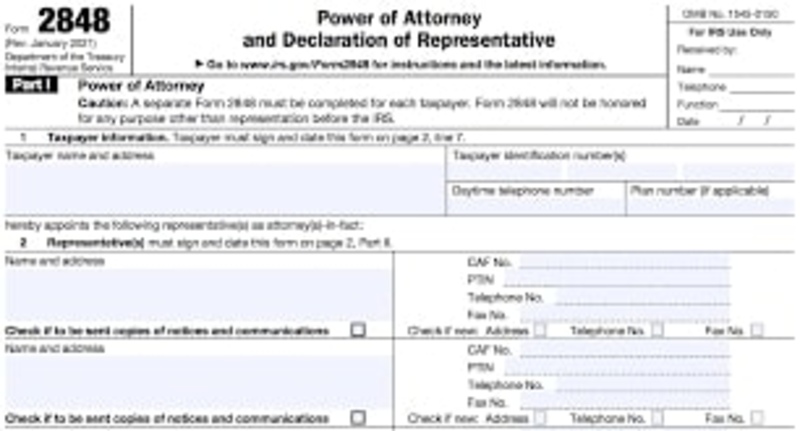

Form 2848, titled 'Power of Attorney and Declaration of Representative', is a crucial legal document utilized by the Internal Revenue Service (IRS) in the United States. This form's purpose is to authorize an eligible individual or entity, such as a certified public accountant, attorney, or family member, to represent another person before the IRS, acting on their behalf concerning federal tax matters. Understanding the ins and outs of Form 2848 is key to ensuring smooth communications and operations with the IRS, whether you're a taxpayer seeking assistance or a representative stepping into this vital role. In this guide, we aim to decode Form 2848, delving into its various aspects including when and how to use it, the roles and responsibilities of all parties involved, and important considerations to bear in mind when dealing with this form.

Overview of Form 2848

At its core, Form 2848 serves as a power of attorney to grant authority to an individual or entity to act on behalf of another person or business entity before the IRS. This form can be used for various tax matters, such as filing taxes, responding to inquiries or notices from the IRS, and making agreements or settlements. The representative appointed through this form can also access the taxpayer's confidential information and discuss tax matters with the IRS on their behalf.

Who Can Use Form 2848?

Form 2848 is typically used by taxpayers who are unable to handle their own tax affairs due to various reasons, such as illness, physical absence, or lack of knowledge or expertise. The representative appointed through this form must be eligible to practice before the IRS, including certified public accountants, licensed attorneys, and enrolled agents. In certain cases, an individual with a power of attorney granted through state law can also act as a representative.

How to fill out Form 2848

Filling out Form 2848 involves providing basic information about the taxpayer and representative, including their names, addresses, and taxpayer identification numbers. The form also requires specifying the tax matters for which the representative is authorized to act on behalf of the taxpayer. This includes selecting specific tax forms or schedules and indicating any limitations on this authority.

Important Considerations

When filling out Form 2848, it is crucial to ensure accuracy and completeness. Any errors or omissions in the form can lead to delays or rejections from the IRS, ultimately causing potential issues for both the taxpayer and representative. It's also essential to review and update this form regularly, especially when there are changes in either party's information or circumstances.

The components of Form 2848

Form 2848 consists of several key components that must be carefully reviewed and understood by both the taxpayer and representative. These include:

Taxpayer Information

This section of the form requires providing the taxpayer's personal information, including their name, address, and taxpayer identification number. It also includes a space to indicate whether the individual is a fiduciary acting on behalf of an estate or trust.

Representative Information

Similar to the taxpayer information section, this portion of the form asks for the representative's details, such as their name, address, and authorized representative designation. The representative must also fill out Part II of the form, providing their qualifications and credentials to act on behalf of the taxpayer.

Tax Matters

In this section, the taxpayer must specify the tax matters for which they are authorizing the representative to act on their behalf. This includes selecting specific forms and schedules and indicating any limitations or special instructions.

Signature and Date

The taxpayer must sign and date the form, certifying that all the information provided is true, correct, and complete to the best of their knowledge. The representative must also sign and date the form in Part II, acknowledging their authorization and commitment to comply with IRS regulations.

Role of a representative in tax matters

The representative appointed through Form 2848 plays a crucial role in helping taxpayers navigate their tax affairs with the IRS. They act as a liaison between the taxpayer and the IRS, communicating on behalf of the taxpayer and handling any necessary paperwork or negotiations.

Responsibilities of a Representative

As an authorized representative, it is essential to understand your responsibilities towards both the taxpayer and the IRS. This includes maintaining confidentiality and adhering to all IRS regulations and rules when handling tax matters on behalf of the taxpayer. It also involves keeping accurate records and promptly notifying the IRS of any changes in your representation status or information.

When to use Form 2848?

Form 2848 should be used whenever a taxpayer needs representation before the IRS. This can include situations where the taxpayer is unable to handle their own tax matters or when they prefer to have a representative communicate with the IRS on their behalf. It is important to note that Form 2848 only authorizes representation for federal tax matters and cannot be used for state or local taxes.

Common mistakes to avoid when filling out Form 2848

When filling out Form 2848, it is crucial to avoid common mistakes that can lead to delays or rejections from the IRS. Some of these include:

- Incorrect or incomplete information: Any errors or omissions in the form can cause delays and potential issues for both the taxpayer and representative.

- Not updating the form regularly: It's important to review and update Form 2848 regularly, especially when there are changes in either party's information or circumstances.

- Not providing specific tax matters: The taxpayer must specify the exact tax matters for which they are authorizing the representative to act. Failure to do so may result in limited or no authority for the representative to handle certain tax matters.

- Not signing and dating the form correctly: Both the taxpayer and representative must sign and date the form to validate its authenticity. Failure to do so may result in rejection from the IRS.

- Not understanding responsibilities: As a representative, it is important to fully understand your responsibilities towards both the taxpayer and the IRS before signing Form 2848. This includes maintaining confidentiality and adhering to all IRS regulations and rules when handling tax matters on behalf of the taxpayer.

Conclusion

Filling out Form 2848 correctly and regularly updating it is crucial for ensuring effective representation before the IRS. By understanding its key components and responsibilities, both taxpayers and representatives can navigate tax matters efficiently and effectively. It is also essential to avoid common mistakes when filling out this form to prevent any delays or rejections from the IRS. Seeking guidance from a certified professional, such as a tax attorney or enrolled agent, can also help ensure accuracy and compliance when using this form. Overall, Form 2848 serves as an important tool for taxpayers who require representation in their dealings with the IRS, providing a clear and authorized line of communication between the two parties.

Decoding the Success: How GEICO Car Insurance Lives Up to the Hype

Explore the success factors of GEICO, one of the top car insurance providers in the US, highlighting its customer-centric approach, financial stability, and innovative marketing strategies.

Jan 16, 2024 Triston Martin

Your Guide to Buy Valero Energy Corporation Stock

Do you want to know about Valero Energy Corp? This article will provide stepwise guide to buy Valero Energy Corp stocks

Jan 12, 2024 Triston Martin

14 Retirement Money Management Strategies for a Secure Future

Discover essential tips for effective retirement planning, including strategies for maximizing savings and ensuring a financially secure future.

Mar 21, 2024 Triston Martin

Early Bird Benefits: The Advantages of E-Filing Your Taxes Now

Explore the advantages of e-filing taxes early, from mitigating tax fraud risks to securing quicker refunds and maximizing financial health.

Mar 21, 2024 Triston Martin

Emergency Banking Act of 1933:What was it, its Purpose, and Importance

Are you someone who wanted to read up on the Emergency Banking Act of 1933? This article has you covered on it

Jan 01, 2024 Susan Kelly

Decoding SEC Form 13F: Significance, Filing, and Critical Issues

A comprehensive guide to SEC Form 13F, detailing its purpose, limitations, and proposed reforms while highlighting its crucial role in institutional investment transparency.

Jan 08, 2024 Susan Kelly